Automation of payment reminders

Automation of payment reminders

Automation of payment reminders for upcoming payments increases payment collection efficiency, reduces the risk of potential delays, and simultaneously improves customer experience. Various types of tools are used for this purpose as part of simple and effective communication. We have gathered for you the most important information about the automation of payment reminders and the principles worth following.

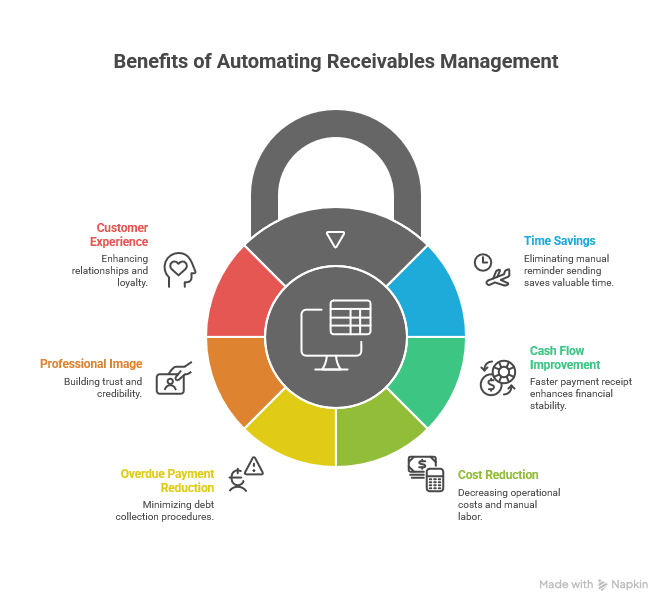

Benefits of payment reminder automation

Automatic invoice reminders translate into a number of benefits from the perspective of both the entrepreneur and the contractor or customer, including improved timeliness of payments and reduced operational costs. In practice, this means better receivables collection. On the other hand, the customer does not forget about payments, and gentle reminders have a positive effect on their experience with the brand. This aspect should be considered on many levels and from different perspectives.

The main benefits of automating receivables management include:

- saving time by eliminating manual reminder sending,

- improving cash flow through faster payment receipt,

- reducing operational costs and manual labor in receivables management,

- decreasing the number of overdue payments and initiated debt collection procedures,

- building the image of a professional and trustworthy entity,

- enhancing customer experience and building long-term relationships.

Be sure to check how to monitor payments and conduct effective debt collection using the tools provided by EasyCall.

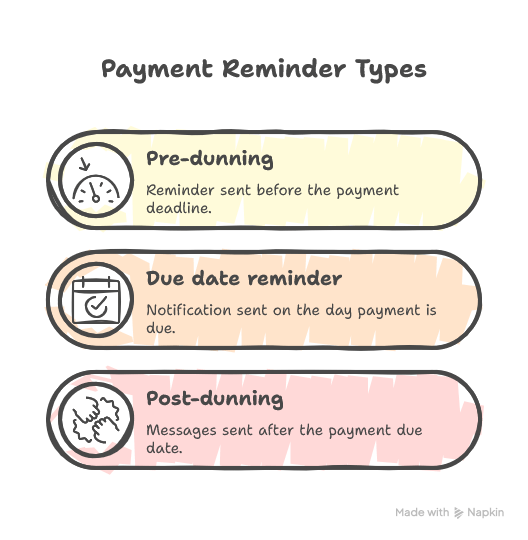

3 types of communication in payment automation

Payment reminder automation can be divided into three basic types of communication:

- Pre-dunning – a so-called pre-term reminder sent a few days before the upcoming payment deadline.

- Due date reminder – a notification sent on the day the payment is due.

- Post-dunning – all messages sent after the payment due date in a specified sequence, e.g., one day after, seven days after, fourteen days after, etc., with a tone that becomes more firm and assertive rather than merely informative.

Best practices in automated receivables management

When automating the sending of reminders about upcoming payments, including invoice due dates, it is worth following several proven practices. They indicate the need for personalized communication, maintaining high accuracy in amounts and dates, and simplifying the payment process through dedicated payment links. These practices are described below.

Personalization of communication

Messages sent within automated reminders should be personalized. A proven practice is to include customer data, invoice number, amount, and payment due date. The style and tone of communication should be adjusted to the client’s previous contact history with the brand, which is facilitated by an in-depth analysis of collected data.

Choosing the sending schedule

Each company should determine the most effective schedule for sending debt collection messages. Typically, one reminder is sent before the due date and another on the due date itself. Later, cyclical messages are sent as part of amicable debt collection.

Porozmawiaj z naszym specjalistą

Multichannel communication

A recommended solution in payment reminder automation is multichannel communication. In practice, this means integrating various tools and reaching out to the client through different channels, including email messages, SMS messages, or phone calls. As a rule, the communication channel should be chosen based on the client’s preferences and previous experience, although this rule can be adjusted in cases of overdue debts.

Shortening the payment process

To shorten the payment process and improve the customer experience, it is worth including a dedicated link that directs the recipient to secure payment methods. Ensure the process is optimized for mobile devices, as they are used most frequently. The fewer steps the customer has to take, the higher the likelihood they will complete the payment immediately after receiving the notification.

Strategy tailored to customer profile

Each customer has different characteristics, so segmentation is key. The data collected is an extremely valuable asset for any business. Try dividing your customers into groups, such as those who pay regularly on time, those who occasionally delay payments, and those who are habitually late with their payments. Prepare a different strategy for each group, taking into account communication tone and message timing.

Monitoring results and improving the process

The manager’s task is to continuously monitor the entire process and track its effectiveness. It is also advisable to gather feedback from customers and customer service representatives. A voicebot can also be used in this process. The collected data allows regular analysis of the process’s effectiveness and helps identify areas for optimization. Continuous improvement of the payment reminder and debt collection procedures translates into higher company efficiency in this area. It is worth staying up to date with technological innovations and using them consciously.

Intelligent debt collection – what does it involve?

Intelligent debt collection is a process of recovering overdue receivables from invoices or contracts while using online tools. A great example of this is our soft debt collection voicebot. With it, you can implement automated debt collection along with real-time payment monitoring. The core idea is communication automation focused on reminding clients about upcoming and overdue payments as part of so-called soft debt collection. The goal is to reduce the risk of delays or the need for legal proceedings while relieving company employees. Many basic and repetitive tasks are handled by tools, while employee responsibilities are limited mainly to monitoring the entire process.

This process also uses a range of other tools, including:

- SIPP – Intelligent Call Presentation System,

- Mass campaigns of interactive voice messages (VMS) with IVR,

- Combined VMS and SMS campaigns,

- Virtual call center agent,

- International numbering,

- IVR phone announcements,

- Callback widget – for free callbacks from the website.

Thus, multiple contact channels with the debtor are considered, increasing the creditor’s chances of recovering funds. At the same time, it does not require hiring additional debt collection specialists or reallocating other company resources, which could inegatively affect core operations. Learn more about how automated debt collection works.

Automate payment reminders with EasyCall

Be sure to explore our offer and automate your payment reminders with EasyCall. For years, we have been supporting entrepreneurs in this process. Based on an analysis of your company’s needs and specifics, we will prepare a tailored implementation proposal within automatic debt collection systems. This will increase your company’s efficiency in recovering funds and reduce the scale of overdue payments. It is an excellent choice for companies selling products both in one-time and subscription models.

A great example of this is our implementation for the EduGO school, which struggled with high costs and the involvement of staff in the debt collection process. Discover this client’s story and see how we can help you.