Voicebot in soft debt collection – conversation scenarios and best practices

Voicebot in soft debt collection – conversation scenarios and best practices

In the financial sector, the effectiveness of receivables recovery at an early stage, known as soft debt collection, directly determines a company’s financial liquidity. The challenge lies in reminding customers about payment in an effective way that does not damage the customer relationship. In 2026, market leaders are moving away from mass, irritating SMS campaigns in favor of intelligent voice automation. A voicebot in soft debt collection is a tool that enables large-scale yet personalized communication, combining empathy with the uncompromising precision of algorithms.

In short: Key takeaways from the article

- Soft debt collection automation enables contact with thousands of debtors in real time, immediately after the payment due date has passed.

- Intelligent conversation scenarios ensure that the bot not only reminds customers about the outstanding amount but can also record a payment commitment and send payment details.

- Ethics and empathy embedded in AI models help maintain a positive brand image even in difficult financial situations for the customer.

- Integration with CRM and ERP systems ensures that the bot contacts only those who have actually failed to settle their obligations, avoiding errors.

- The effectiveness of voicebots in soft debt collection is 30–40% higher than that of traditional text or email campaigns.

The psychology of soft debt collection: Why voice outperforms text?

Soft debt collection is primarily an informational and educational process. Customers often fail to pay not because they are unwilling, but because they forgot or misplaced an invoice. SMS messages are frequently ignored or treated as spam. A phone conversation carries a completely different psychological weight.

By using an AI voicebot, a company can initiate a dialogue. The bot does not “attack” the debtor but acts as a payment assistant. Thanks to naturally sounding speech synthesis, the patient (or customer) feels treated as a subject rather than an object. This communication strategy allows tension to be de-escalated within the very first minute of the conversation.

Conversation scenarios: From reminder to payment commitment

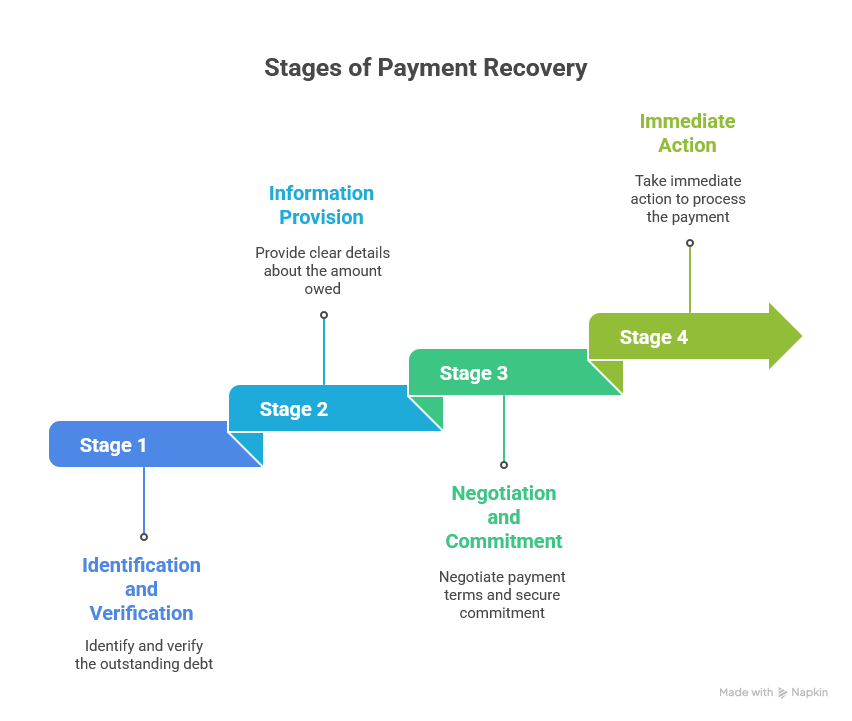

The key to a successful debt collection bot lies in a well-designed scenario (workflow). At EasyCall, we create conversation trees that anticipate various debtor responses, ensuring a smooth and coherent dialogue.

Stage 1: Identification and verification

The bot begins by verifying the caller’s identity (e.g., requesting a date of birth or the last digits of the national ID number). This is necessary due to voicebot data security requirements and legal obligations related to banking or commercial secrecy.

Stage 2: Providing information about the outstanding amount

The bot communicates the amount owed and the invoice number in a factual and calm manner. Thanks to integration with the company’s financial system, the information is always up to date.

Stage 3: Negotiation and payment commitment

This is where the AI “magic” happens. The bot asks, “When can we expect the payment?” If the customer declares a date (e.g., “I will pay this Friday”), the virtual consultant records this date directly in the CRM system and schedules an automatic reminder for the declared payment day.

Stage 4: Immediate action

The bot may offer: “Would you like me to send you the payment details and a quick payment link via SMS right now?” This functionality dramatically increases the repayment rate (Conversion Rate) already during the first interaction.

Operational benefits: Scale and precision

Traditional call centers in debt collection struggle with high employee turnover and significant stress levels. A voicebot eliminates these issues. It can make 10,000 calls per hour—something physically impossible for a human team. Moreover, LMM technology is a “game changer” in today’s voice communication.

Moreover, the bot is immune to the debtor’s emotions. It always remains polite, professional, and compliant with procedures. Our experience from other demanding sectors, where reducing the number of unanswered calls was critical, shows that the consistency and inevitability of contact provided by a bot help build a habit of timely payments among debtors.

Table: Effectiveness of voicebots in debt collection processes

| Process attribute | Debt collector (Human) | Voicebot AI (EasyCall) | Business impact |

|---|---|---|---|

| Throughput | Approx. 15–20 calls/hour | Unlimited (thousands/hour) | Faster reach to the receivables portfolio |

| Cost per call | Very high | Low | Higher recovery profitability |

| Stress resistance | Low (burnout) | Absolute | Consistent communication quality |

| Data collection | Manual CRM notes | Automatic logs and transcripts | Error-free analytics |

| Effectiveness (soft) | High but selective | Very high (scale effect) | Shortened payment cycle |